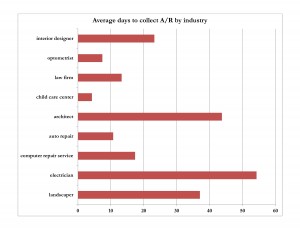

A/R collections by industry

It’s critical that you collect money owed to you as quickly as possible for three reasons. First, the longer it takes to collect, the less likely you are to get 100% of what’s owed to you. Second, cash is king in this economy. Take a look at what the stock market is doing lately and then try to argue that cash is not a good position to have. Finally, there are several common elements that I’ve observed within long-term successful businesses and one of these is the ability to collect money faster than what is the average for that industry.

Notice the average days outstanding for accounts receivable within these various industries. It varies widely from one type of business to another. The big takeaway is that you need to be better than your industry peers, regardless of what kind of business you own. Understand that this goal, strategy, or whatever you want to call it, is a very powerful way to correct all kinds of working capital problems within an organization. Here’s an example.

Suppose you own a residential electrical repair service and although sales are growing every month, you ability to collect the money is not very good. It takes you about 54 days on average to get paid. If you currently have around $100,000 in accounts receivable and you improve the average time it takes to collect from 54 days to 40 days, you would free up (or collect) $25,000. Imagine what you could do with that money! Improving the collection period to 30 days would free up $43,000.

You can’t find this diagnostic tool in QuickBooks or any other accounting software. If you’d like to have an analysis performed on your receivables, please let me know. You cannot afford to let your customers dictate your collections period.

Posted in: Blog

Leave a Comment (0) ↓